Our top tip for the 2024-2025 tax year: Be prepared!

Make sure your records are in order for the end of the tax year. Acting early will save time, reduce stress, and ensure your business is set up for success in 2025.

Note: Make sure to unmute the demo so you can listen to the full commentary and instructions.

“BOMA was exactly what a firm like ours was looking for. In the past we found digital marketing complex and time consuming. With BOMA, it’s so easy and the support team are awesome. If you are unsure, give the 14 day trial a go and have a play.”

Luke Sawyer, Woottons, Australia

Connecting with your clients and prospective clients through high-value content helps to build and strengthen relationships. It can also help to boost your brand awareness and help to promote your offering service. BOMA makes it easy to stay in touch.

It’s easy. Simply select the article you want for a specific campaign. Next you can personalise and customise as much as you want including adding additional images from our image library, with over 5 million to choose from. BOMA automatically reformats the content across the different email and social channels, then press send.

Many Accountants & Financial Advisors struggle to write regular content for their website and to include in their newsletters and social posts. For many, as it’s not a billable activity they either outsource it at great expense or do it in house with mixed results. BOMA comes with a huge library of customisable and ready-to-share articles making blog post writing a breeze.

Try our ROI calculator to see how much time and money you can save when using BOMA’s customisable content for your emails, social posts and blog posts.

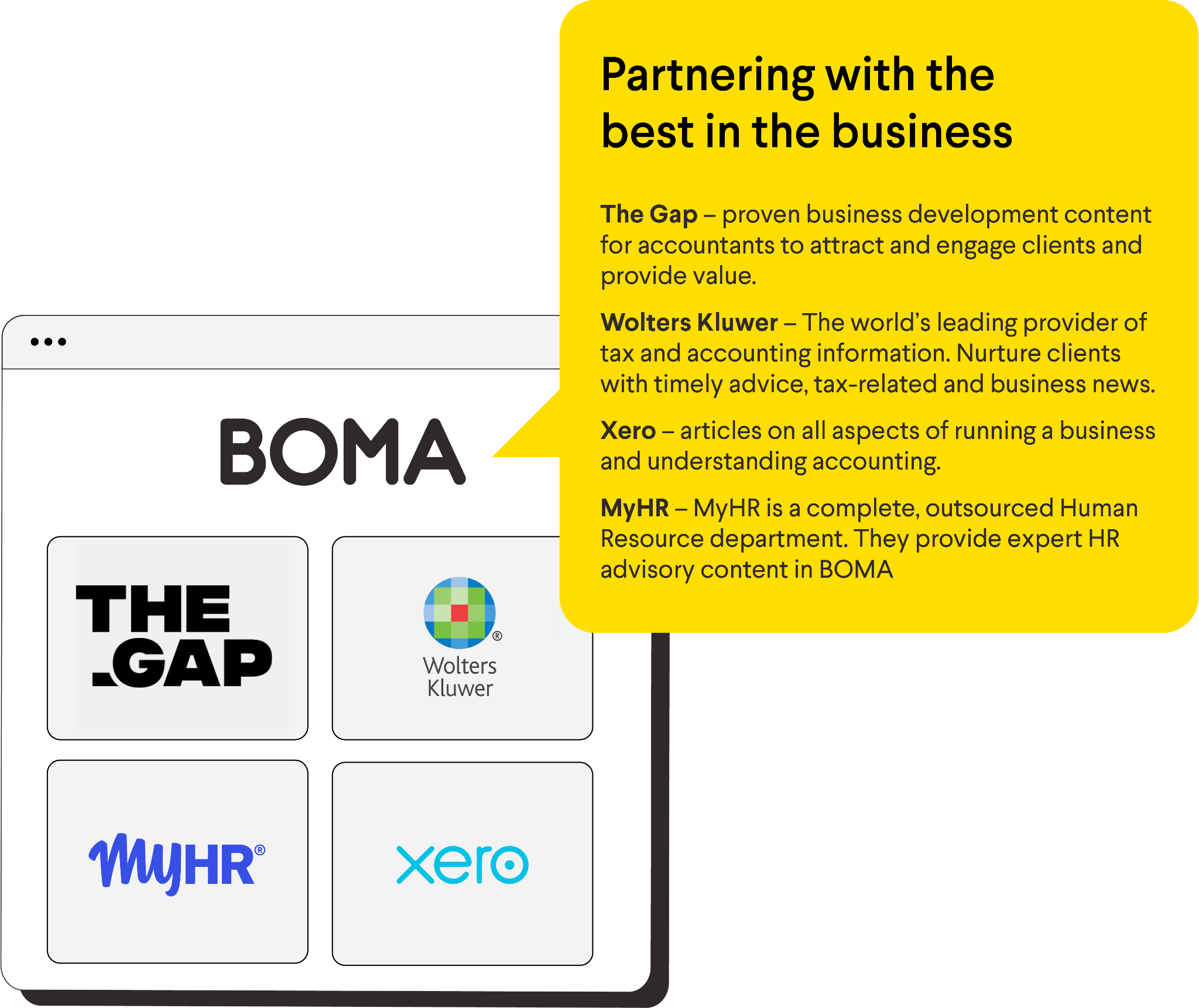

BOMA proudly partners with:

![]()

![]()

![]()

![]()