The Complete Guide to Marketing Analytics for Accounting Firms: Tracking ROI Across All Channels (Made Simple)

Table of Contents

- Why do marketing analytics matter for your accounting practice?

- What are the three essential numbers every accountant should track?

- How do you set up your marketing tracking system?

- How do you measure email marketing success?

- What social media metrics actually matter for accounting firms?

- Why is client retention more important than acquisition?

- How do you track client communication effectiveness?

- What common analytics mistakes should you avoid?

- How do you make data-driven marketing decisions?

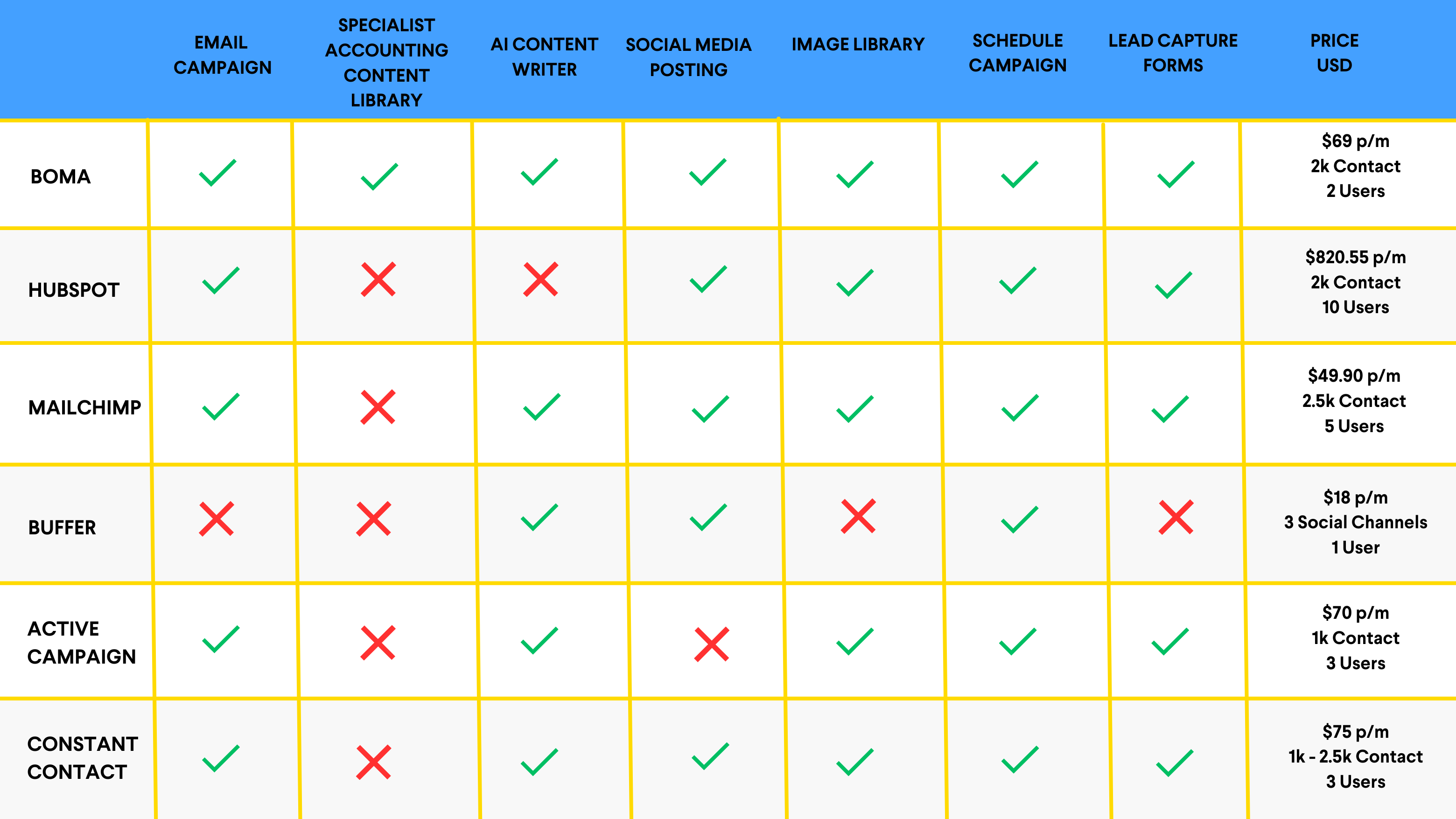

- How does BOMA compare to other marketing platforms?

- Ready to transform your accounting firm’s marketing?

“Why do marketing analytics matter for your accounting practice?

Marketing analytics help accounting firms measure which activities generate the most valuable clients and highest return on investment. Just as you wouldn’t run a client’s business without understanding their profit and loss, you shouldn’t run marketing campaigns without knowing which ones bring in paying clients.

Recent research shows that high-growth accounting firms spend 2.1% of their revenue on marketing, while slower-growing firms allocate only 1%. These high-growth firms achieve revenue growth rates of 38.5%, up to seven times faster than their peers. However, only 36% of marketers can accurately measure ROI, with 47% struggling with attribution tracking.

What does this mean for your practice?

Consider this simple example: if you spend $2,000 monthly on marketing and gain three new clients worth $20,000 each annually, you’re looking at $60,000 in revenue from a $24,000 investment. That’s a 150% return.

Without proper tracking, you won’t know whether that $2,000 should go toward:

- Online marketing platforms

- Google advertising campaigns

- Content creation

- Email marketing

- Social media marketing

- Local networking events

What are the three essential numbers every accountant should track?

#three-essential-numbers

Before implementing complex analytics systems, focus on these three metrics that directly impact your bottom line: cost per client, client lifetime value, and marketing ROI.

- How much does it cost to acquire each new client?

Calculate this by dividing total marketing expenses by new clients gained. If you spend $1,000 on marketing and gain two clients, your cost per client is $500.

The average B2B customer acquisition cost is $536. This gives you a benchmark for evaluating your performance.

- What is the total value of each client relationship?

Don’t just count first-year revenue. A client paying $20,000 annually who stays five years generates $100,000 in lifetime value. This metric helps justify marketing investments and identify your most valuable client segments.

- What return are you getting on marketing investment?

Use this formula: (Revenue from new clients – Marketing costs) ÷ Marketing costs × 100

Example: ($3,000 in new client revenue – $1,000 marketing costs) ÷ $1,000 × 100 = 200% return

Why simple tracking beats complex systems

Many accounting firms get overwhelmed by marketing software promising to track everything. Start with these three core metrics using a basic spreadsheet. You’ll capture 80% of the insights needed for smart decisions.

Complex attribution systems can wait until you’ve mastered the fundamentals. BOMA provides intuitive analytics, avoiding the complexity of general marketing platforms.

How do you set up your marketing tracking system?

Create a marketing ledger similar to your financial records, tracking all activities, costs, and results systematically.

Step 1: Build your marketing ledger

Set up a spreadsheet with these essential columns:

- Date: When the marketing activity occurred

- Activity Type: Google ads, networking, social media, referrals

- Cost: Direct expenses plus your time at hourly rate

- Leads Generated: Number of inquiries received

- Clients Converted: Inquiries that became paying clients

- Client Value: Annual fee value of new clients

Update monthly like any other business record. This transforms marketing from guesswork into measurable data.

Step 2: Systematically track client sources

Ask every new client: “How did you first hear about our services?” Provide specific options:

- Google search results

- LinkedIn connection or post

- Referral from [specific person/firm]

- Local networking event

- Facebook or other social media

- Email campaign or newsletter

- Professional directory

- Other (specify)

Record responses consistently. After six months, clear patterns emerge showing which activities generate valuable clients.

Step 3: Calculate monthly performance metrics

At month-end, determine:

- Monthly Client Acquisition Cost: Total marketing spend ÷ New clients

- Average New Client Value: Total annual value ÷ Number of new clients

- Monthly Marketing ROI: (Client value – Marketing spend) ÷ Marketing spend × 100

Track these like monthly revenue. Look for trends in costs, client value, and seasonal patterns.

How do you measure email marketing success?

Email marketing delivers $36 to $42 for every dollar spent, making it the highest-ROI marketing channel for accounting firms.

Essential email metrics for accounting firms

- What open rates should you target?

Accounting firms should aim for 20-25% open rates, compared to the industry average of 16.19%. Track monthly to identify engagement trends.

2. How do you measure click engagement?

Industry averages show 7.42% click-through rates for accounting firms. However, 3-5% represents a realistic target for most campaigns. This metric indicates content relevance to your audience.

3. When should you worry about bounce rates?

Keep bounce rates below 12.22% (industry average). Higher rates indicate list quality issues requiring immediate attention.

4. How do you track actual business results?

Most importantly, monitor email inquiries converting to clients. High engagement without client acquisition indicates content misalignment.

Calculate email marketing ROI: (Revenue from email clients – Email costs) ÷ Email costs × 100

Example: Spending $200 monthly and generating one $3,000 client = 1,400% ROI.

Email marketing best practices

How should you segment your audience?

Track performance by:

- Existing clients vs. prospects

- Service types and specialisations

- Client company size

- Geographic location

BOMA allows easy audience segmentation with customised content for different groups.

What testing should you implement?

Test these elements systematically:

- Subject line variations

- Send times and days

- Content formats and length

- Call-to-action placement

Ready to improve your email marketing? Work out your ROI when using BOMA’s platform via our ROI calculator.

What social media metrics actually matter for accounting firms?

Focus on business results rather than vanity metrics—likes and shares don’t pay bills, but client inquiries do. Social media success for accounting firms means tracking activities that generate actual business.

LinkedIn – Average engagement rate for professional services is 2.3–2.4%, with multi-image posts reaching 6.6% and videos about 5.6%.

Facebook – Accounting-focused pages typically record engagement rates (likes, comments, shares) around 1–2% of total followers, aligning with general small-business averages of 1.5%to 3%.

X (Twitter) – Engagement for B2B firms averages 0.5–1% per post, reflecting lower interaction rates on that platform.

Instagram – while less commonly used by accountants, when deployed, engagement ranges 2–3% for educational content.

Why LinkedIn Is Your Primary Platform

LinkedIn holds unparalleled value for accountants as the main professional networking platform with over 790 million professionals. It typically generates higher-quality leads than Facebook or Instagram for B2B services.

BOMA supports LinkedIn Personal, LinkedIn Business, Facebook, and X (Twitter) posting directly from their platform, with content designed for professional audiences.

Key LinkedIn metrics to monitor

Track these business-focused metrics monthly:

- Profile Views: Professional visibility indicators

- Quality Connections: Growth within your target market

- Content Engagement: Meaningful interactions on posts

- Direct Inquiries: Messages requesting services

- Website Traffic: Clicks from LinkedIn to your site

How Do You Calculate Social Media ROI?

Use this formula: (Revenue from social media clients – Time investment cost) ÷ Time investment cost × 100

Include your hourly rate when calculating time costs. If you spend 10 hours monthly on LinkedIn at $100/hour ($1,000 investment) and generate one $2,500 client, your ROI is 150%.

BOMA’s Social Media ROI calculator automates these calculations and shows time and cost savings from using ready-to-share content versus creating everything from scratch.

Platform-specific analytics

How do you track engagement quality?

Monitor engagement rates across platforms. Professional services see higher engagement on LinkedIn compared to Facebook or Instagram. BOMA’s accounting specific content typically achieves better engagement than generic business posts.

Which platforms generate the best leads?

Document inquiry sources and track conversion rates by platform. This identifies where to focus limited time and resources.

What content performs best?

Educational content about compliance and advisory services outperforms promotional content for accounting firms. BOMA’s library includes extensive educational content covering tax, compliance, strategy, HR, technology, business management and more topics.

Why is client retention more important than acquisition?

Acquiring a new customer costs >5 times more than retaining an existing one, making client retention the most profitable marketing activity for accounting firms. For accounting practices specifically, acquisition costs are approximately 6-7 times higher than retention costs, depending on the service offered e.g. individual tax preparation vs business advisory.

The financial impact of retention

Professional services firms enjoy an 84% average customer retention rate. However, small accounting firms often see retention rates around 60-70%, while larger firms achieve 75-85%. This difference reflects the resources dedicated to client relationship management.

The revenue impact is substantial:

- Companies have a 60-70% chance of selling to existing customers

- Only a 5-20% chance of selling to new prospects

- Increasing retention by 5% can boost profits by 25-95%

Why keeping clients informed protects your revenue

If you’re not proactively sharing important business information with clients, they’ll seek it elsewhere—potentially from your competitors. This creates opportunities for other firms to establish relationships and demonstrate value.

Regular client communication serves three critical functions:

- Competitive Protection: Proactive information sharing prevents clients from seeking updates elsewhere

- Revenue Growth: Creates natural upselling opportunities for additional services

- Cost-Effective Marketing: Retention of a client costs a fraction versus the cost of acquiring new clients

BOMA’s content library includes hundreds of compliance updates, advisory insights, and business growth articles specifically designed to keep your clients informed and engaged.

The economics of client retention

Client communication impact

Regular communications and updates create natural opportunities to introduce additional services and grow revenue per client. Existing customers are 50% more likely to try new products and spend 31% more than new customers.

Revenue growth through upselling

For accounting firms, this translates to opportunities for advisory services, compliance consulting, and specialised business guidance. BOMA’s platform makes it easy to segment your communications and target specific services to relevant client groups.

How do you track client communication effectiveness?

Newsletter and client update performance

What engagement rates should you expect?

Existing clients typically show 25-35% open rates, higher than prospect emails. BOMA’s content library provides compliance updates and industry insights that keep clients engaged.

How do you measure upselling success?

Track additional service inquiries generated by client communications. This directly measures upselling effectiveness and return on communication investment.

Which clients are most at risk?

Compare retention rates between clients engaging with communications versus those who don’t. Engaged clients show significantly higher retention rates.

Measuring revenue impact

How much does client communication increase revenue?

Clients receiving regular updates typically show 20-30% higher annual value. BOMA’s content helps position your firm as a trusted advisor, creating advisory service opportunities beyond basic compliance.

What’s the ROI of client retention activities?

Monitor these quarterly metrics:

- Service Expansion Rate: Percentage of clients purchasing additional services

- Revenue Per Client Growth: Annual value increases over time

- Cross-Selling Success: Clients buying complementary services

BOMA’s segmentation features allow targeting specific services to relevant client groups based on industry or business needs.

What common analytics mistakes should you avoid?

Most accounting firms make predictable analytics mistakes that lead to poor marketing decisions and wasted resources.

Mistake 1: Tracking vanity metrics instead of business results

What are vanity metrics?

These metrics look impressive but don’t drive revenue:

- Website page views without conversion tracking

- Social media followers who aren’t prospects

- Email subscribers who never engage

- Blog traffic from irrelevant audiences

What should you track instead?

Focus on metrics tied to business outcomes:

- Inquiries from qualified prospects

- Conversion rates from inquiry to client

- Revenue per marketing channel

- Client lifetime value by acquisition source

BOMA’s analytics focus on business-relevant metrics rather than vanity measurements.

Mistake 2: Ignoring time investment costs

Why this matters

Many accountants underestimate marketing costs by ignoring time investment. If you spend 10 hours monthly on social media at $100/hour, that’s $1,000 in marketing investment—not free marketing.

How to calculate true costs

Include these time investments:

- Content creation and curation

- Social media management and engagement

- Email campaign development and sending

- Analytics review and reporting

- Client communication and follow-up

BOMA’s ROI calculators include time savings in their calculations, showing how the platform reduces required time and resources investment.

Mistake 3: Expecting immediate results

Why marketing takes time

Marketing works like compound interest—results build over time. Consistent content creation or networking efforts may take months to generate clients but produce steady long-term results.

Realistic timeline expectations

Month 1-3: Foundation building, minimal direct results

Month 4-6: Initial lead generation and relationship building

Month 7-12: Consistent client acquisition and referral generation

Year 2+: Compounding effects and sustainable growth

Track results over 6-12 month periods rather than month-to-month for accurate performance assessment.

Mistake 4: Neglecting client retention analytics

The retention vs. acquisition imbalance

While acquisition metrics are important, retention metrics often provide higher ROI insights. Many firms focus exclusively on new client generation while ignoring existing client satisfaction and engagement.

Essential retention metrics

Track these client retention indicators:

- Client satisfaction scores and feedback

- Communication engagement rates

- Service expansion and upselling success

- Retention rates by client segment

- Revenue growth per retained client

Retention activities typically offer 5-25 times better ROI than acquisition efforts.

Mistake 5: Using generic industry benchmarks

Why accounting firms need specific benchmarks

Generic business benchmarks don’t reflect accounting industry patterns. Tax season volatility, regulatory compliance requirements, and professional service dynamics create unique performance characteristics.

Where to find accounting-specific data

Use benchmarks from:

- Accounting industry association reports

- Professional services marketing studies

- Accounting practice management survey

- Platforms like BOMA that specialise in accounting firms

Book a 1-on-1 demo with BOMA to see how your firm’s performance compares to accounting industry benchmarks.

How do you make data-driven marketing decisions?

Transform analytics data into strategic business decisions that drive sustainable practice growth and improved profitability.

How to use ROI data for budget decisions

Treat marketing budget allocation like any investment decision. If networking events generate clients at $300 each while Google ads cost $800 per client, allocate more resources to networking—unless ad-generated clients have higher lifetime value.

Client quality vs. quantity analysis

Consider these factors when evaluating marketing channels:

- Average client lifetime value by source

- Payment reliability and speed

- Referral generation potential

- Service expansion opportunities

- Retention rates by acquisition channel

A channel generating fewer clients, but higher-value relationships may be more profitable long-term.

When to stop, continue, or expand marketing activities

Clear decision criteria

Stop activities when:

- Cost per client exceeds client lifetime value

- Consistent failure to generate qualified inquiries over 6+ months

- Excessive time investment with poor ROI

- Channel performance declining despite optimisation efforts

Continue activities when:

- Positive ROI with stable or improving trends

- Strong client quality even if volume is lower

- Activities complement other successful marketing efforts

- Performance meets industry benchmarks for accounting firms

Expand activities when:

- Strong ROI with potential for scaling

- High-quality client generation with good retention rates

- Clear opportunity for optimisation and improvement

- Channel aligns with long-term business strategy

Retention vs. acquisition decision framework

Prioritise retention activities because they typically offer 5-25 times better ROI than acquisition efforts. BOMA’s platform excels in retention through regular, valuable client communications.

Retention priority indicators:

- Client satisfaction scores below 8/10

- Retention rates below industry averages (75-85%)

- Limited upselling or service expansion success

- Competitor pressure in your market

Strategic planning integration

How to integrate analytics with business planning

Quarterly Business Reviews: Include marketing performance as a standing agenda item

Annual Strategic Planning: Use marketing data to inform service development and market expansion

Client Advisory Services: Leverage your analytics expertise to help clients with their marketing measurement

Partnership Decisions: Evaluate referral partner performance using systematic tracking

Long-term growth strategy development

Use analytics data to inform:

- Service line expansion decisions based on client demand patterns

- Geographic expansion based on digital marketing reach and success

- Target market refinement using client profitability and satisfaction data

- Competitive positioning based on differentiation opportunities identified through analytics

How does BOMA compare to other marketing platforms?

BOMA is the only marketing platform designed exclusively for accounting firms, providing industry-specific content and integrations that general platforms lack.

Marketing platform comparison

Key BOMA differentiators

Industry-specific content library

BOMA provides the only integrated accounting-specific content library with ready-to-share articles. Content comes from renowned industry partners including:

Unlike the other marketing platforms, BOMA includes a comprehensive content library with hundreds of accounting-specific articles updated weekly. These articles can be customised and shared across a variety of channels including email, social media and your website blog. This eliminates content creation costs that can exceed $300 per article when outsourced.

If you don’t have the time or internal resource to run your own marketing then BOMA’s managed service packages can offer you:

- Done-for-email and social media campaigns

- SEO-optimised blog posts

- Regular analytics and performance reports

See BOMA’s Managed Service packages for total hands-off digital marketing, starting from AUD $199/month.

Accounting-specific integrations

BOMA integrates with popular accounting applications:

- Practice Management: Xero, QuickBooks, Karbon, Ignition, FYI, IRIS

- CRM Systems: HubSpot, Salesforce

- Communication Tools: Various accounting-specific platforms

Dedicated support and training

Most general platforms offer limited support on lower-tier plans. BOMA provides comprehensive onboarding, account setup, and ongoing training free for all users.

Experience the difference of an accounting-focused platform. Start your 14-day free trial of BOMA today.

Ready to transform your accounting firm’s marketing?

Marketing analytics success doesn’t require becoming a marketing expert—it requires consistent tracking, smart analysis, and data-driven decisions. The accounting firms mastering marketing analytics today will dominate tomorrow’s competitive marketplace.

Start your marketing journey with BOMA’s 14-day free trial. Experience industry-specific content, multi-channel campaigns, and analytics designed exclusively for accounting firms.

Want personalised guidance? Book a 1-on-1 demo to see how BOMA can help your firm’s marketing without the complexity of general business marketing platforms.

Your analytical skills as an accountant are perfect for marketing analytics—you just need the right tools and systematic approach to succeed.